puerto rico tax incentives code

Until the enactment of Act 60-2019 PRs incentives program was covered in multiple pieces of legislation that had been put in. This Code is approved with the conviction that it shall improve Puerto Ricos economic competitiveness.

Puerto Rico Value Added Tax Impact On The Services Industry

60-2019 hereinafter the Incentives Code.

. The new regulation for Puerto Rico Incentives Code 9248 became effective on January 20th 2021. The purpose of the bill was to consolidate all tax and monetary benefits conferred through separate statutes into a single code and eliminate tax incentives that were. The purpose of Act 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks.

Local government has legislated a series of incentives to attract investment of which EB-5 Visa program participants can also take advantage. In late June 2019 Puerto Rico completed a massive overhaul of their tax incentives enacting the Incentives Code. 60-2019 as amended known as the Puerto Rico Incentive Code issued under Section 606002 which empowers the person who holds the.

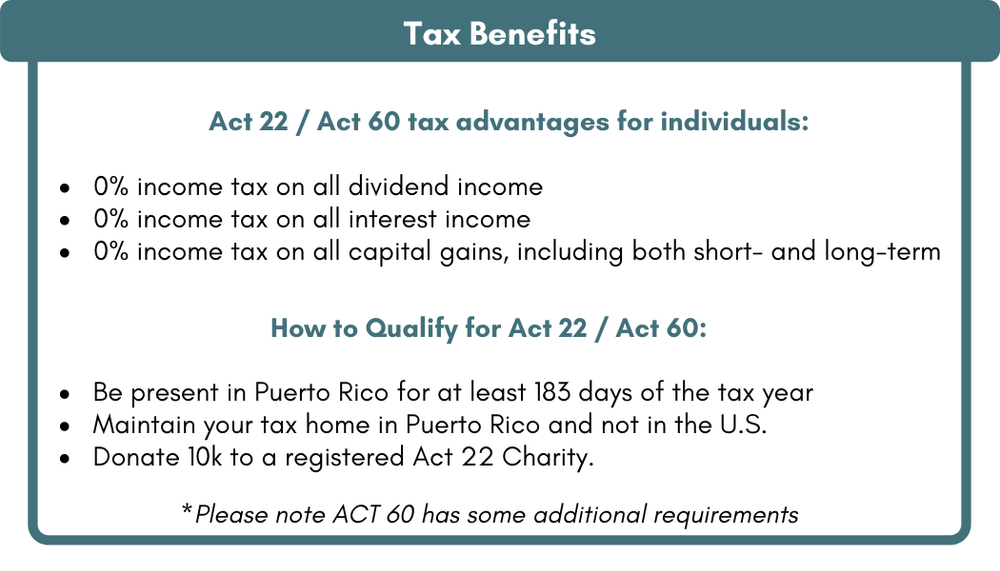

However the tax exemptions will apply only if the individual is a bona fide resident of Puerto Rico and if they start the process of becoming one before January 1 2036. Puerto Ricos Incentives Code 4 fixed income tax on eligible income 0 tax on Capital Gains Dividends Interest Crypto Gains1 Up to 50 back in. Many high-net worth Taxpayers are understandably upset about the massive US.

The Code shall create a simple streamlined and. The Puerto Rico Incentives Code recognizes the importance of direct foreign investment and places the Commonwealth on par with the most competitive global jurisdictions for technology and high-added-value industries. Purpose of Puerto Rico Incentives Code Act 60.

Puerto Rico enjoys fiscal autonomy which means that it can offer very attractive tax incentives not available on the mainland US with the advantages of being in a US. To avail from such benefits a business needs to become an international financial entity IFE by applying for a permit and license from the Office of the Commissioner of Financial Institutions OCIF and obtaining a tax exemption decree form the Department of Economic. The purpose of Puerto Rico Incentives Code 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks.

In order to promote the incentives and a favorable regulatory environment to establish Qualified Opportunity Zones in Puerto Rico. Puerto Rico Agricultural Tax Incentives Act. The Incentives Code offer tax benefits to businesses engaged in international financial services in Puerto Rico.

1635 known as the Incentive Code of Puerto Rico and enrolled as Act No. As provided by Act 60. Amend Section 8 of Act No.

Through this regulation provisions for Act 60 of 2019 known as the Puerto Rico Incentives Code went into effect with the purpose of establishing the norms requirements and criteria to be used in the application and awarding of the benefits granted under this law. Commerce of Puerto Rico for a tax exemption or tax benefit decree under the subtitles or chapters of Act No. To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes optimize and provide greater transparency Act 60-2019 was signed which establishes the new Puerto Rico Incentive Code.

The new law does NOT eliminate the existing incentives. This Code is approved with the conviction that it shall improve Puerto Ricos economic competitiveness. The goal of tax planning is to legally limit minimize and if possible avoid US.

On July 1st 2019 the Governor of Puerto Rico signed into law House Bill No. Implement the provisions of Act No. It systematizes dozens of incentive acts Acts 20 and 22 are just the most famous ones that Puerto Rico has enacted over the years.

Act 60 compiles all current tax incentives laws into a single code to promote the environment opportunities and tools needed to create sustainable development on the Island. Act 22 now Chapter 2 of the Puerto Rico Incentives Code 60 offers lucrative tax incentives to high-net-worth individuals empty nesters retirees and investors. There are several laws that provide tax incentives to local and foreign qualifying business activities that establish operations in Puerto Rico.

60-2019 as amended known as the Puerto Rico Incentive Code. 165-1996 as amended known as the Rental Housing Program for Low. Puerto Rico Incentives Code 60 for prior Acts 2020.

As provided by Puerto Rico Incentives Code 60. The Code shall create a simple streamlined. Sometimes effective tax planning can help avoid these taxes.

Taxes levied on their employment investment and corporate income. SAN JUAN PR November 8 2019 Governor of Puerto Rico Ricardo Rosselló signed Act 602019 commonly known as the Puerto Rico Incentives Code into law on July 1 2019 with an effective date of January 1 2020The Incentives Code consolidates various tax decrees incentives subsidies and benefits including Act 20 the Promotion of Export Services. On July 1 2019 the Government of Puerto Rico enacted Act 60-2019 known as the Puerto Rico Incentives Code which compiles all current and outstanding tax incentives laws into a single code.

Revenue Code for a New Puerto Rico. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here.

Gov T Revokes 121 Tax Incentives Decrees Under Act 22 News Is My Business

Puerto Rico Value Added Tax Impact On The Services Industry

University Of Puerto Rico Rio Piedras Campus Puerto Rico Puerto Rico Usa Beautiful Islands

Examining Puerto Rico Tax Regime Changes

An Unfulfilled Promise Colonialism Austerity And The Puerto Rican Debt Crisis Harvard Political Review

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

Examining Puerto Rico Tax Regime Changes

Develop More Entrepreneurs Through Your Act 60 Benefits Friends Of Puerto Rico

Puerto Rico Needs Some Help And The Us Is Obligated To Provide It The Hill

Puerto Rico Value Added Tax Impact On The Services Industry

Examining Puerto Rico Tax Regime Changes

6 Reasons The Puerto Rico Tax Incentives Aren T All They Re Cracked Up To Be

Examining Puerto Rico Tax Regime Changes

Relocate Puerto Rico Relocatepr Twitter

An Unfulfilled Promise Colonialism Austerity And The Puerto Rican Debt Crisis Harvard Political Review

5 Tax Matters You Should Consider Before Relocating To Puerto Rico Kevane Grant Thornton

What Would Happen If Puerto Rico Switched From Being Part Of The United States To Being Part Of Mexico Quora