child tax credit 2021 income limit

Families with a single parent also called Head of Household with income of 200000 or less. Up to 96 of US households with children qualify for at least some of the 2021 child tax credit.

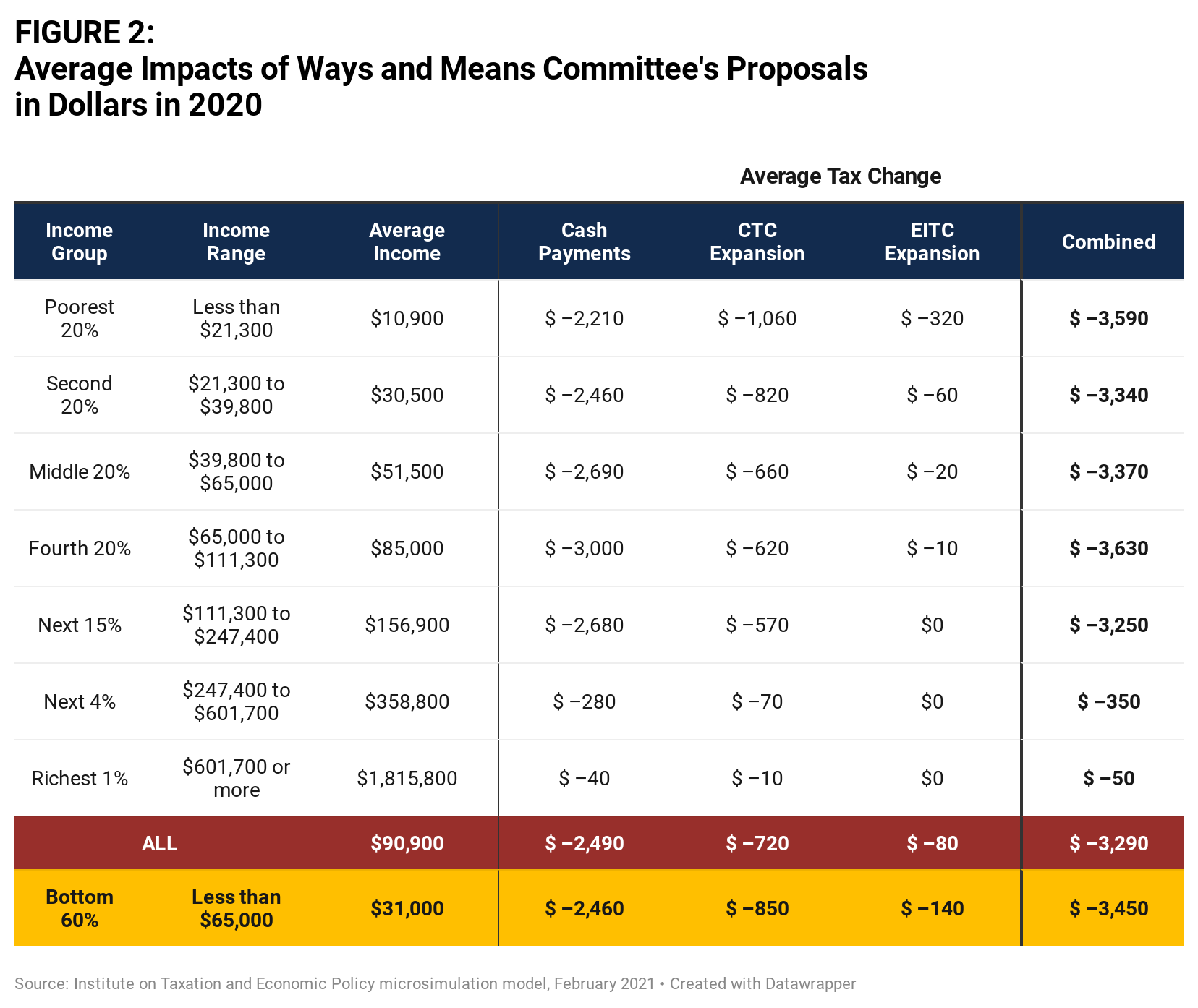

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

The first phaseout can reduce the Child Tax Credit to.

. The advance is 50 of your child tax credit with the rest claimed on next years return. We expected our CTC to be 6000 with the new rule minus the 2100 we already. The Child Tax Credit wont begin to be reduced below 2000 per child until the taxpayers modified AGI in 2021 exceeds.

They earn 150000 or less per year for a married couple. Added June 14 2021 Q C5. What is my modified AGI.

Ad The new advance Child Tax Credit is based on your previously filed tax return. Added June 14 2021. How does the second phaseout reduce the remaining 2000 Child Tax Credit.

Are you using any. The iPhone at 15. Our kids are 15 and 13.

This is up from 16480 in 2021-22. Under the new Child Tax Credit expansion in 2021 you are able to get the credit if your child is 17 and under. The overall credit is reduced by 50 for every 1000 over the phaseout or limit until its eliminated entirely.

Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance. Previously you were not able to get this credit for your child if they. For the tax year 2021 the Child Tax Credit is increased from 2000 per qualifying child to.

If you took advantage of the advance. How does the first phaseout reduce the 2021 Child Tax Credit to 2000 per child. The American Rescue Plan raised the 2021 Child Tax Credit from 2000 per child to 3000 per child for children over the age of 6 and from 2000 to 3600 for children under the age of 6.

And 3000 for children ages. Child Tax Credit rates The maximum. Childcare element of Working Tax Credit The maximum weekly childcare costs you can claim for and percentage of costs covered are shown below.

Up to 3600 per qualifying dependent child under 6 on Dec. The Child Tax Credit phases out in two different steps based on your modified adjusted gross income AGI in 2021. To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022-23 tax year.

Families making 150000 a year or less will get the full credit. The payment for children. 3600 for children ages 5 and under at the end of 2021.

For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. The limit on investment income is now 10000 and will.

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 per child for qualifying children under the age of 6 and to 3000 per child for qualifying. Added June 14 2021 Q C4. They earn 112500 or less for a family with a single parent commonly known as Head of Household.

We received 2100 in advanced Child Tax Credit CTC in 2021. If you earn more than this. Get the up-to-date data and facts from USAFacts a nonpartisan source.

Married couples filing a joint return with income of 400000 or less. Only for tax years beginning in 2021 Section 9611 of the American Rescue Plan Act increases the refundable portion of the child tax credit to 3000 for qualifying children who. For the first phaseout in 2021 the child tax credit begins to be.

The American Rescue Plan Act of 2021 raised the amount of the child tax credit to 3000 per child or 3600 per child under age 6. In previous years 17-year-olds werent. More workers and working families who have income from retirement accounts or other investments can still get the credit.

But age and income requirements could make families completely ineligible. When you go through the process of filling out your 2021 tax return you will be able to claim the full credit for your newborn dependent. This is up from the 2020 child tax credit.

Up to 3000 per qualifying dependent child 17 or younger on Dec. Everyone else with income of. These people qualify for a 2021 Child Tax Credit of at least 2000 per qualifying child.

400000 if married and filing a joint return. The credit amounts will increase for many. Families making 150000 a year or less will get the full credit.

Ad Discover trends and view interactive analysis of child care and early education in the US.

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Here S Who Qualifies For The New 3 000 Child Tax Credit

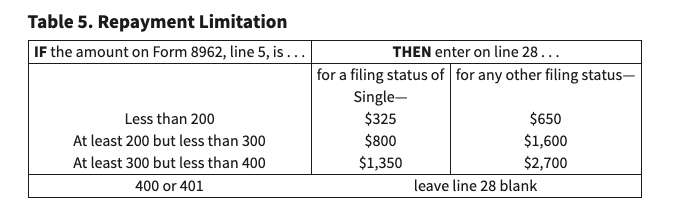

What S The Most I Would Have To Repay The Irs Kff

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Politifact Sen Manchin Wrong On Income Limits For Child Tax Credit Extension In Build Back Better

Child Tax Credit Schedule 8812 H R Block

2021 Child Tax Credit Advanced Payment Option Tas

Advanced Tax Credit Repayment Limits

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

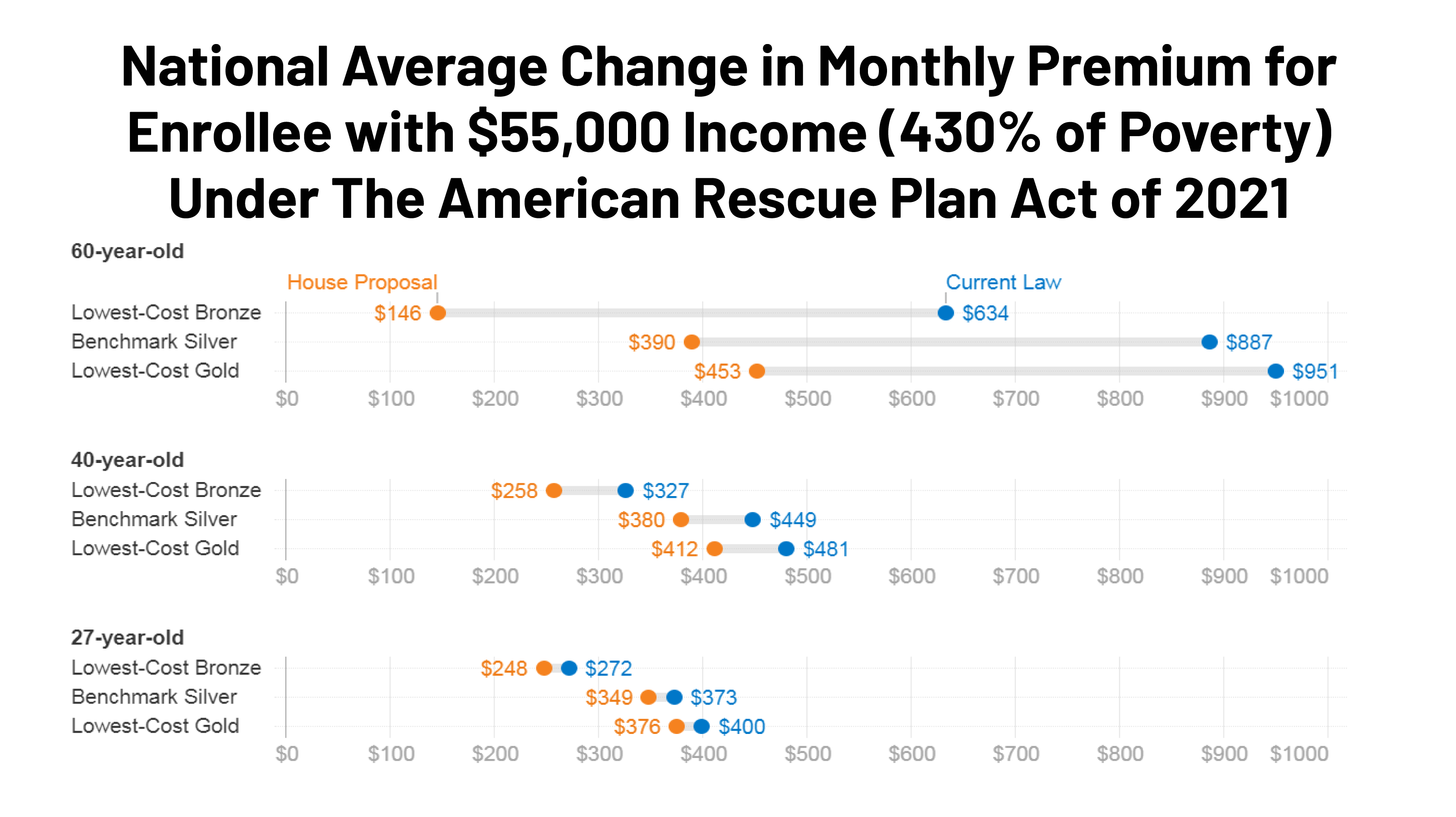

Impact Of Key Provisions Of The American Rescue Plan Act Of 2021 Covid 19 Relief On Marketplace Premiums Kff

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

What Families Need To Know About The Ctc In 2022 Clasp

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center